Introduction: The Financial Strain of Pet Ownership

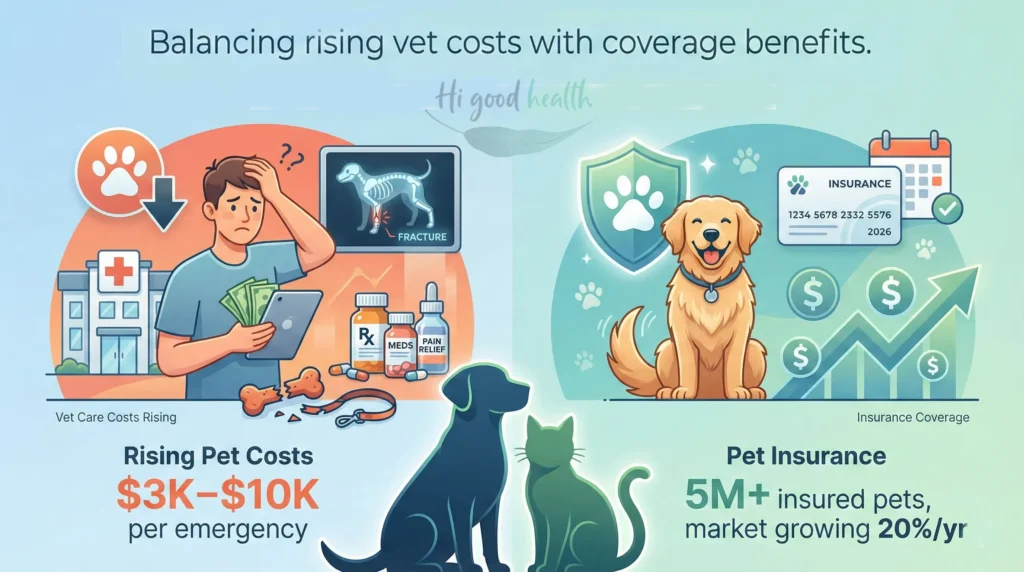

According to industry data, U.S. pet owners spent approximately $152 billion on pets in 2024, with total veterinary care and product expenses topping $40 billion and rising year over year, driven by inflation and advanced treatment options (American Pet Products Association, PetDesk).

A single emergency — such as surgery for a swallowed toy, a broken bone, or ongoing cancer treatment — can easily cost several thousand dollars, creating a sudden financial shock that many families are unprepared for.

Enter pet insurance. According to the North American Pet Health Insurance Association (NAPHIA), there were an estimated 7 million insured pets in North America at the end of 2024, and the market exceeded $5.2 billion in written premiums, reflecting strong year-over-year growth of approximately 20% in premium volume, according to the NAPHIA 2026 State of the Industry Report.

But is pet insurance a smart investment — or just another monthly bill?

How Pet Insurance Works in the US

Unlike human health insurance, pet insurance typically follows a reimbursement model:

- Step 1: You pay the vet bill upfront.

- Step 2: File a claim with your insurer.

- Step 3: Receive reimbursement (usually 70–90%).

Key Components

- Premiums: Monthly payments, usually $40–70 for dogs, $20–40 for cats.

- Deductibles: $250–$500 per year or per incident.

- Reimbursement rate: 70–90%.

- Annual limits: Some plans cap payouts at $10,000–$15,000; others are unlimited.

What’s Covered (and What’s Not)

Usually Covered

- Accidents and injuries.

- Surgeries and hospitalizations.

- Diagnostic tests (X-rays, MRIs, bloodwork).

- Prescription medications.

- Chronic conditions, if covered before diagnosis.

Usually Not Covered

- Pre-existing conditions.

- Preventive care (vaccines, flea/tick prevention, dental cleanings).

- Elective procedures.

- Exotic pets (birds, reptiles, rabbits).

💡 Some providers (like Nationwide) offer add-ons for wellness care and even exotic pets.

The Cost of Vet Care in 2026

- Dog emergency surgery (ACL/CCL tear): $4,000–$7,000.

- Cancer treatment (surgery, chemotherapy, or radiation): $5,000–$12,000

- Hospitalization for pancreatitis: $2,500–$5,000

- Routine dental cleaning: $400–$800 (often not covered by insurance)

- Veterinary care — especially emergency and specialized treatments — continues to climb, with unexpected bills often reaching several thousand dollars, according to consumer finance analyses by Kiplinger.

Without insurance or savings, many families face what veterinarians call “economic euthanasia” — the heartbreaking situation in which a treatable pet must be euthanized because the cost of care is unaffordable. This is not a failure of love or responsibility, but a reflection of rising medical costs and limited financial preparedness.

To truly understand the hidden costs of pet obesity, check our detailed The Hidden Cost of Pet Obesity: How It Impacts Your Wallet, Your Pet’s Happiness, and Your Familyblog

Case Studies: Real US Pet Owners

Case 1: Bailey the Golden Retriever (Denver, CO)

Bailey tore her ACL while playing fetch. Surgery cost $6,500. Her owners paid $55/month in premiums and were reimbursed $5,200 after deductible. Insurance made the difference between financial stress and life-saving surgery.

Case 2: Max the Cat (Chicago, IL)

Max developed urinary blockages, requiring multiple ER visits totaling $4,200. Without insurance, his retired owner would have faced credit card debt. Insurance reimbursed 80%, making long-term management possible.

Case 3: Luna the French Bulldog (New York, NY)

Frenchies are prone to breathing issues. Luna’s surgery cost $8,000. Insurance covered 70%, but premiums had risen to $90/month due to her breed’s risk. Luna’s owner realized insurance was essential for high-risk breeds.

Pet Insurance vs Alternatives

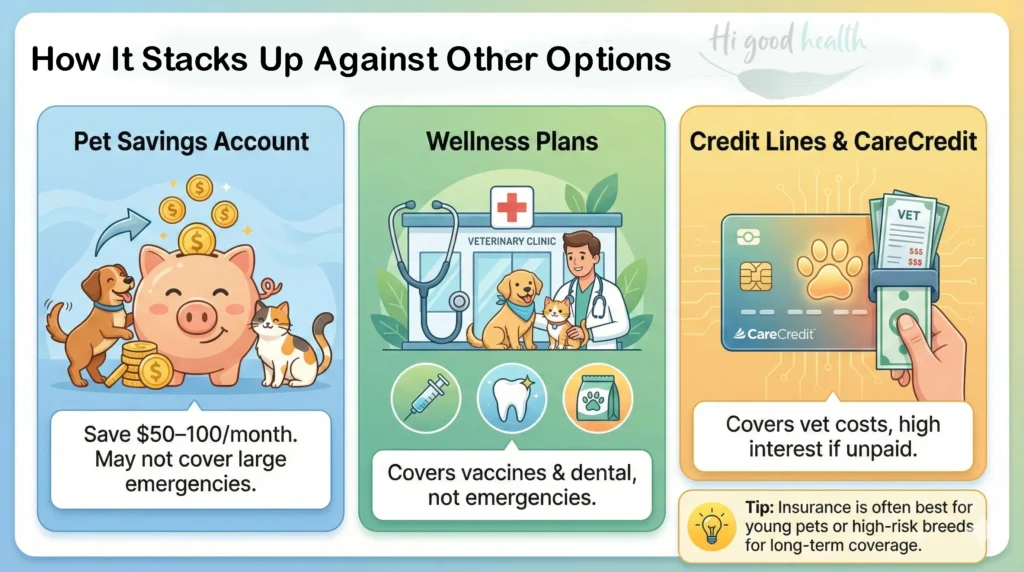

1. Pet Savings Account

Setting aside $50–$100 per month in a dedicated savings account can work if your pet remains relatively healthy and emergencies are rare. However, a single $5,000–$7,000 emergency early in a pet’s life can quickly drain years of savings.

2. Wellness Plans

Offered by veterinary chains such as Banfield (PetSmart), VCA, and others, wellness plans typically cover routine preventive care like vaccinations, exams, and sometimes dental cleanings. They do not cover accidents, emergencies, or serious illnesses, and should not be confused with insurance.

3. Credit Lines & CareCredit

Veterinary credit options, including CareCredit, can help cover unexpected costs in the short term. However, these often carry high interest rates if balances are not paid off within promotional periods, potentially increasing the overall cost of care.

💡 Insurance is often most valuable for young pets, large breeds, or genetically high-risk breeds, where the likelihood of costly medical care over a lifetime is higher.

Industry Trends in 2026

- Growth: NAPHIA reports approximately 20% annual growth in premium volume, with strong year-over-year increases in insured pets.

- Tech integration: Apps allow instant claims and reimbursements.

- Customization: More policies tailored by breed, lifestyle, and region.

- Controversy: Rising premiums for popular breeds (bulldogs, retrievers).

Short- vs Long-Term Considerations

Short-Term Benefits

- Peace of mind during emergencies.

- Avoiding high-interest debt.

- Encouraging proactive vet visits.

Long-Term Considerations

- If your pet stays healthy, premiums may outweigh payouts.

- But most pets develop chronic issues by age 8–10, when coverage pays off.

Step-by-Step: Deciding If Insurance Is Right for You

- Assess Breed Risk

- Bulldogs, retrievers, Siamese cats = higher health risks.

- Evaluate Finances

- Can you cover a $5,000 bill tomorrow? If not, insurance is worth exploring.

- Compare Providers

- Trupanion: No payout caps, higher premiums.

- Healthy Paws: Strong accident coverage.

- Nationwide: Exotic pet coverage.

- Review Fine Print

- Exclusions matter more than coverage lists.

- Some policies exclude hereditary conditions.

To learn more about tick-borne diseases threatening pets in 2026, read our in-depth blog

FAQs

It prevents “economic euthanasia” when facing emergency bills of $3,000–$10,000. While it may not save money if your pet stays healthy, it ensures you never have to choose between your wallet and your pet’s life.

No, conditions diagnosed before coverage starts are excluded. However, if you insure your pet before issues arise, chronic conditions are typically covered for life, making early enrollment crucial.

Unlike human insurance, you pay the vet upfront, file a claim, and get reimbursed 70–90%. Some modern apps now allow for instant claims, but standard processing typically takes about 1–2 weeks.

Standard accident and illness plans usually exclude preventive care like vaccines and dental cleanings, which can cost $400–$800. You generally need a separate “wellness” add-on to cover these routine expenses.

Yes, but expect higher premiums and exclusions for pre-existing issues. Coverage is often best purchased for young pets, as many develop chronic conditions by age 8–10 that would be covered if insured early.

Yes. Indoor cats still face costly emergencies like urinary blockages ($4,200+) or cancer. Insurance protects against these sudden, high-cost medical events even if the cat never goes outside.

Yes. Because you pay upfront and are reimbursed later, you can use any licensed veterinarian in the U.S., including specialists and emergency hospitals, without worrying about “in-network” restrictions.

Likely, yes. Inflation and your pet’s aging typically drive costs up. High-risk breeds, like Bulldogs or Retrievers, may see steeper increases as they grow older and become prone to breed-specific health issues.

Final Thoughts

For American pet parents in 2026, the decision about pet insurance is both financial and emotional. It won’t always “save money,” but it ensures you never have to choose between your wallet and your pet’s life.

If your pet is young, your breed is high-risk, or your savings are limited, insurance can be one of the smartest investments you make. For others, a disciplined savings plan may suffice. Either way, understanding the costs and risks arms you to protect your furry family member.

Glossary

- Deductible: The amount paid out-of-pocket before insurance applies.

- Reimbursement Rate: Percentage of vet bill insurance pays (typically 70–90%).

- Pre-existing Condition: Health issue diagnosed before coverage.

- Wellness Plan: Preventive care coverage (vaccines, dental) separate from insurance.

- Economic Euthanasia: When owners euthanize pets due to financial constraints.